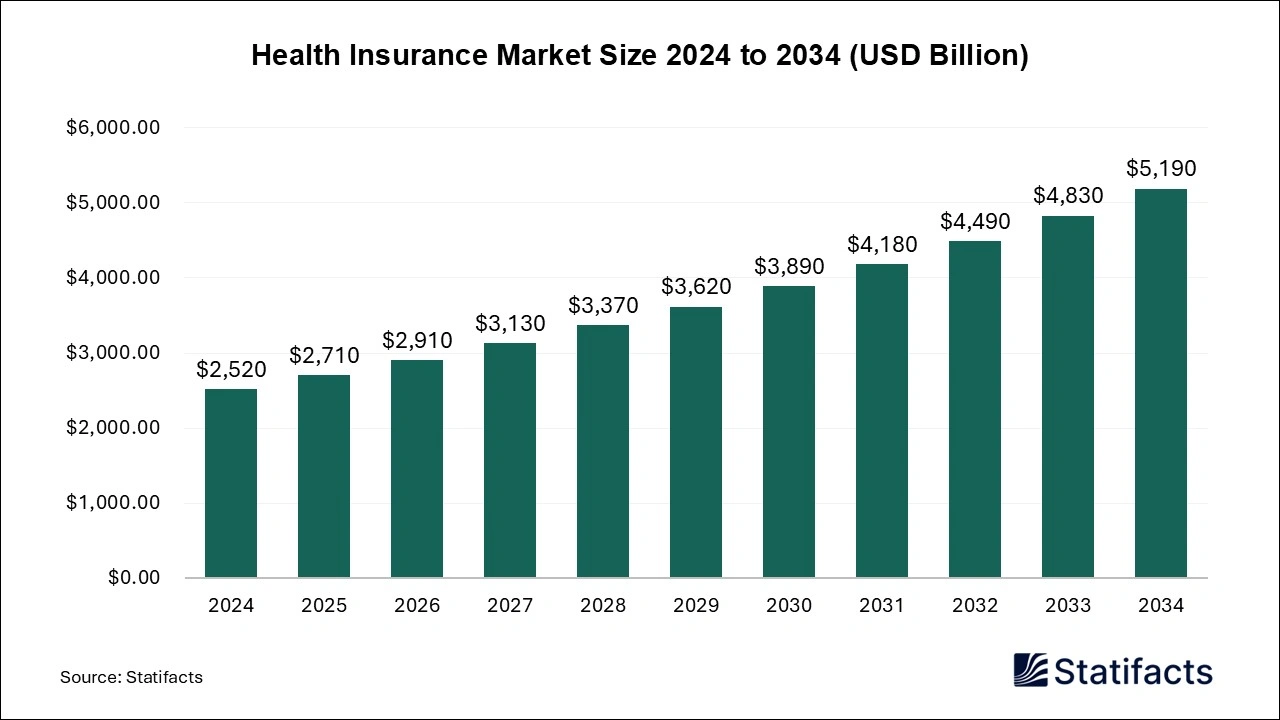

Health Insurance Market Size to Lead USD 5,190 Bn by 2034 Rising chronic diseases and healthcare costs are fueling demand for coverage

The global health insurance market size is predicted to increase from USD 2,710 billion in 2025 and is projected to be worth around USD 5,190 billion by 2034, expanding at a CAGR of 7.5% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, May 02, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global health insurance market size was evaluated at USD 2,520 billion in 2024 and is anticipated to grow around USD 5,190 billion by 2034, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. The health insurance market growth is driven by government initiatives for reimbursement policy development for surgical procedures, high medical costs, rising prevalence of chronic diseases, and a rising senior population.

Request a Sample Databook to Explore our Insights@ https://www.statifacts.com/stats/databook-download/8071

Market Overview

Health insurance is a lifetime, comprehensive coverage that offers complete insurance. Health insurance coverage provides for the payment of benefits as a result of sickness or injury. The benefits of health insurance include covering ambulance fees, yearly checkups, and critical disease-specific plans.

The health insurance market refers to the production, distribution, and use of health insurance, which is a financial tool that provides financial coverage for medical expenses. A health insurance policy is a contract between an individual and the insurance company. Health insurance covers a wide range of medical expenses such as ambulance charges, room rent, doctor’s consultations, cost of surgery, medicines, and more.

Advanced technologies in health insurance policy include mobile apps, social media, predictive and behavioral analytics, application programming interface (API), blockchain, artificial intelligence (AI), robotic process automation (RPA), and telemedicine.

- According to a report by Universal Health Coverage (UHC) tracked jointly by the World Health Organization (WHO) and the World Bank with biannual Global Monitoring Reports, as a Sustainable Development Goal (SDG) 3.8.

Health Insurance Market Key Highlights

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By provider, the public segment underwent notable growth in the market in 2024.

- By provider, the private segment will gain a significant share of the market over the studied period of 2025 to 2034.

- By coverage type, the lifetime coverage segment enjoyed a prominent position in the health insurance market in 2024.

- By coverage type, the term insurance segment is predicted to witness significant growth in the market over the forecast period 2025 and 2034.

- By level of coverage, the silver segment captured a significant portion of the market in 2024.

- By level of coverage, the gold plans segment is anticipated to grow with the highest CAGR in the market during the studied years.

- BY age group, the adult segment maintained a leading position in the health insurance market in 2024.

- BY age group, the senior citizen segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By network provider, the point of service segment is estimated to hold the highest market in 2024.

- By network provider, the preferred provider organizations segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By plan type, the medical insurance segment dominated the health insurance market.

- By plan type, the critical illness insurance segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By distribution channel, the direct sales segment accounted the highest market share in 2024.

- By distribution channel, the brokers/agents segment is anticipated to grow at the fastest rate in the market from 2025 to 2034.

Major Key Trends in the Health Insurance Market:

- Rising prevalence of chronic diseases: There are many health insurance policies in the market that cover many illnesses. Many health insurance plans offer coverage for chronic diseases. Most of the standard health insurance plans cover many chronic conditions, generally after a waiting period.

- Rising senior population: Benefits of buying health insurance for the senior population include high-end diagnostics, safe and secure, a cumulative bonus, tax benefits, paperless policies, an easy claims process, and cashless facilities.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/8071

Limitations & Challenges in the Health Insurance Market:

- Strict regulations for claim reimbursement: There is a need for strict regulations for claim reimbursement in health insurance, including claim procedure, exclusions clause, duty of disclosure, limit of liability, policy period, and insurable interest.

- High cost of health insurance products: The increasing medical inflation greatly impacts health insurance premiums and standardized care. Health insurance is more expensive due to changing healthcare prices, defensive medical practices, profit-driven hospitals, higher salaries for healthcare professionals, and rising drug costs.

Development of Health Insurance Platforms: Market’s Largest Potential

Health insurance software development is an app development process for computers that helps in managing various aspects of health insurance. To develop a health insurance app, first need to implement the main features and build a strong network of healthcare providers and users. A digital health insurance platform is an online platform that allows us to explore and buy health insurance policies digitally.

- In April 2025, the National Health Insurance Platform, known as Dhamani, was launched by the Financial Services Authority (FSA) of Oman. This platform helps to oversee the operations in the country’s health insurance market.

Regional Analysis:

North America Held the Dominant Position: Technological Advancement to Support Growth

North America dominated the global health insurance market in 2024. Increased healthcare expenditure, increased demand for new drugs and surgeries, rising senior population, and increasing prevalence of diseases are driving the growth of the market in the North American region.

Major Factors for the Market’s Expansion in North America

- In February 2025, the UnitedHealth’s Medicare billing probe, the Wall Street Journal reports, was launched by the Unites States Justice Department.

- From January 2025, those applying for a Canadian Super Visa can now use health insurance from non-Canadian providers to meet the Visa requirements.

What Expect from Asian Countries till 2034?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Rising prevalence of the senior population, high spending on medical treatment and surgeries, and rising rate of daycare procedures are driving the growth of the health insurance market in the Asia Pacific region.

Top Asian Countries for Health Insurance Treatment

India: In October 2024, a new health insurance scheme for senior citizens above 70 under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) was launched by Prime Minister Narendra Modi.

Japan: In March 2023, a new cloud-based platform for the healthcare sector in Japan that allows users to securely collect and leverage healthcare data to promote digital transformation in the medical field for drug development and personalized healthcare was launched by Fujitsu Limited.

Health Insurance Market Scope

| Report Attribute | Key Statistics |

| Market Size in 2025 | USD 2,710 Billion |

| Market Size by 2034 | USD 5,190 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.5% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Provider, By Coverage Type, By Network Provider, By Plan Type, By Age Group, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Provider Insights

The public segment held a dominant presence in the health insurance market in 2024. Public health insurance is a system that provides universal coverage for healthcare services to the population, generally funded through a progressive tax structure. Public health insurance offers social welfare benefits like disability and healthcare.

The private segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Private health insurance generally provides access to a wider network of care providers, which results in shorter wait times for visits, elective procedures, and diagnostic tests.

Coverage Type Insights

The lifetime coverage segment accounted for a considerable share of the health insurance market in 2024. Lifetime coverage health insurance benefits include the maximum dollar amount a health plan will pay to an insured individual during that individual’s lifetime. With lifetime health insurance, Mediclaim coverage continues regardless of our age and health conditions.

The term insurance segment is projected to experience the highest growth rate in the market between 2025 and 2034. The term insurance is the life insurance that helps our family members in case of our unfortunate death. Term insurance can be used to replace the income earned by the deceased policyholder and provide critical financial support to the family.

Level of Coverage Insights

The silver segment led the health insurance market. The silver level of coverage is one of the health insurance plans available through the Marketplace, covering all these important health benefits, which provide a more balanced cost-sharing structure.

The gold plans segment is set to experience the fastest rate of market growth from 2025 to 2034. The gold plan cost-sharing structure means the consumer pays 20% for healthcare costs and the insurer pays 80%. It is ideal for families and individuals needing frequent medical services.

Age Group Insights

The adult segment registered its dominance over the health insurance market in 2024. The health insurance for adults’ benefits includes tax benefits, ambulance charges, hospitalization expenses, cashless treatments, and more.

The senior citizen segment is anticipated to grow with the highest CAGR in the market during the studied years. Senior citizen health insurance is a specialized health insurance plan tailored to individual needs. It offers coverage for a wide range of medical spending, including critical illnesses, pre-existing conditions, hospitalization, and even coronavirus treatment.

Network Provider Insights

The point of service segment dominated the health insurance market. Point of service is a type of health insurance plan that provides many benefits depending on whether the policyholder visits out-of-network or in-network healthcare providers.

The preferred provider organizations segment is projected to expand rapidly in the market in the coming years. The preferred provider organization is a type of managed care health insurance plan. The preferred provider organizations (PPO) is a Medicare arrangement that helps medical services like medicines, hospitals, and consultations, all are provided for a cost less than it general plan.

Plan Type Insights

The medical insurance segment maintained a leading position in the market in 2024. The main benefit of medical insurance is providing quality treatment without financial strain. It covers planned and emergency expenses for ambulance charges, pre- & post-hospitalization, surgeries, day care treatments, and hospitalization.

The critical illness insurance segment is predicted to witness significant growth in the market over the forecast period. It is an affordable way and supplement and pay for the additional expenses that can come with a serious illness.

Distribution Channel Insights

The direct sales segment captured a significant portion of the health insurance market in 2024. Insurance is sold directly by an insurer without the involvement of intermediaries like banks, retailers, advisers, brokers, and comparison websites.

The brokers/agents segment will gain a significant share of the market over the studied period of 2025 to 2034. For individual health insurance, the agent’s commission can be up to 15%. The benefit of working with an insurance agent is the personalized advice they provide.

Browse More Research Reports:

- The global IoT insurance market size was valued at USD 4.82 billion in 2024 and is predicted to gain around USD 8.96 billion by 2034 with a CAGR of 6.40% from 2025 to 2034.

- The global solar insurance market size was valued at USD 7,050 million in 2024 and is predicted to gain around USD 15,941 million by 2034 with a CAGR of 8.5% from 2025 to 2034.

- The cybersecurity insurance market size is predicted to gain around USD 86.49 billion by 2034 from USD 16.11 billion in 2024 with a CAGR of 18.3% from 2025 to 2034.

- The global health and wellness market size was calculated at USD 531.95 billion in 2024 and is predicted to reach around USD 1,086.21 billion by 2034, expanding at a CAGR of 7.4% from 2025 to 2034.

- The global home healthcare market size was calculated at USD 423.97 million in 2024 and is predicted to attain around USD 1,504.1 million by 2034, expanding at a CAGR of 13.5% from 2025 to 2034.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/8071

Health Insurance Market Top Companies:

- Cigna Corporation

- CVS Health Corporation

- Allianz

- Centene Corporation

- United Healthcare Services, Inc.

- WellCare Health Plans, Inc.

- National Insurance Company Limited

- Bupa Global

- Humana, Inc.

- AIA Group Limited

Recent Breakthroughs in the Global Health Insurance Market:

- In April 2025, a unified health insurance scheme, Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana, was launched by Odisha, in a landmark step towards universal healthcare.

- In April 2025, New Retail Health Insurance, plans to onboard 3500 hospitals by FY27, was launched by TATA AIG. It helps to strengthen its health insurance portfolio.

Segments Covered in the Report

By Provider

- Public

- Private

By Coverage Type

- Term Insurance

- Life-time Coverage

By Network Provider

- Point of Service

- Preferred Provider Organizations

- Exclusive Provider Organizations

- Health Maintenance Organizations

By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

By Age Group

- Minor

- Adults

- Senior Citizen

By Distribution Channel

- Direst Sales

- Brokers/Agents

- Banks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.